All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash worth of an IUL are normally tax-free as much as the quantity of costs paid. Any kind of withdrawals over this amount may be subject to taxes depending on plan framework. Conventional 401(k) contributions are made with pre-tax bucks, minimizing taxable earnings in the year of the contribution. Roth 401(k) contributions (a plan feature available in the majority of 401(k) plans) are made with after-tax payments and afterwards can be accessed (profits and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the individual is over 59. Possessions withdrawn from a conventional or Roth 401(k) before age 59 may sustain a 10% penalty. Not precisely The insurance claims that IULs can be your own bank are an oversimplification and can be misdirecting for numerous reasons.

You might be subject to upgrading linked health and wellness concerns that can influence your ongoing expenses. With a 401(k), the cash is always yours, consisting of vested employer matching no matter whether you quit adding. Risk and Guarantees: Firstly, IUL plans, and the money worth, are not FDIC guaranteed like common bank accounts.

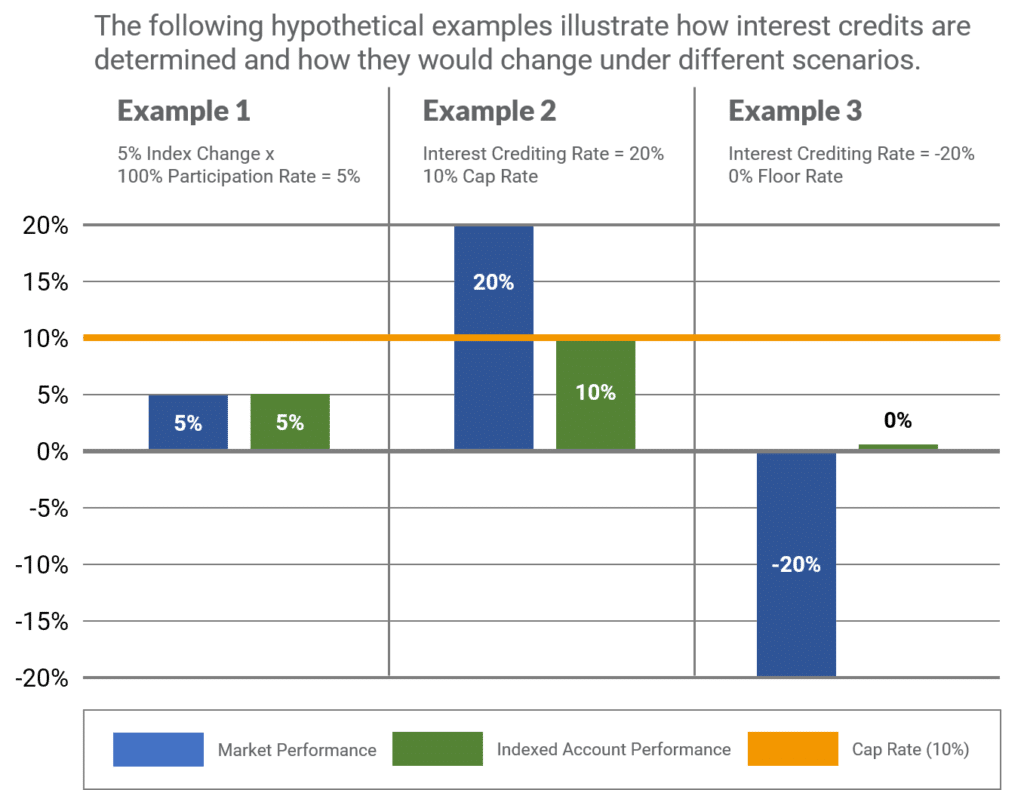

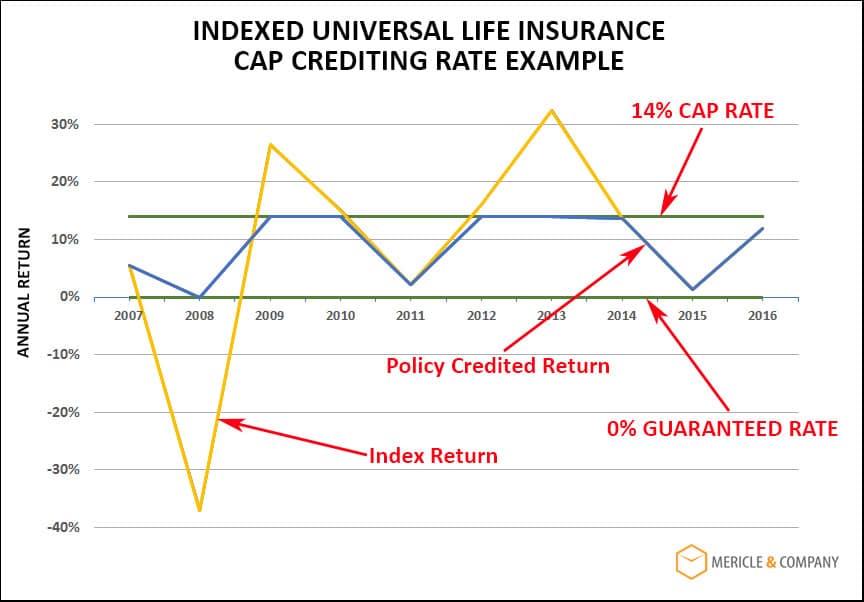

While there is typically a floor to avoid losses, the growth potential is topped (meaning you may not fully gain from market growths). The majority of experts will agree that these are not similar items. If you desire survivor benefit for your survivor and are worried your retired life financial savings will not be sufficient, then you might wish to think about an IUL or various other life insurance coverage item.

Certain, the IUL can offer access to a money account, but once more this is not the main purpose of the product. Whether you desire or require an IUL is an extremely individual inquiry and depends on your main economic objective and goals. Below we will certainly attempt to cover advantages and restrictions for an IUL and a 401(k), so you can better delineate these products and make an extra enlightened choice regarding the ideal means to manage retirement and taking treatment of your liked ones after fatality.

Iul Sales

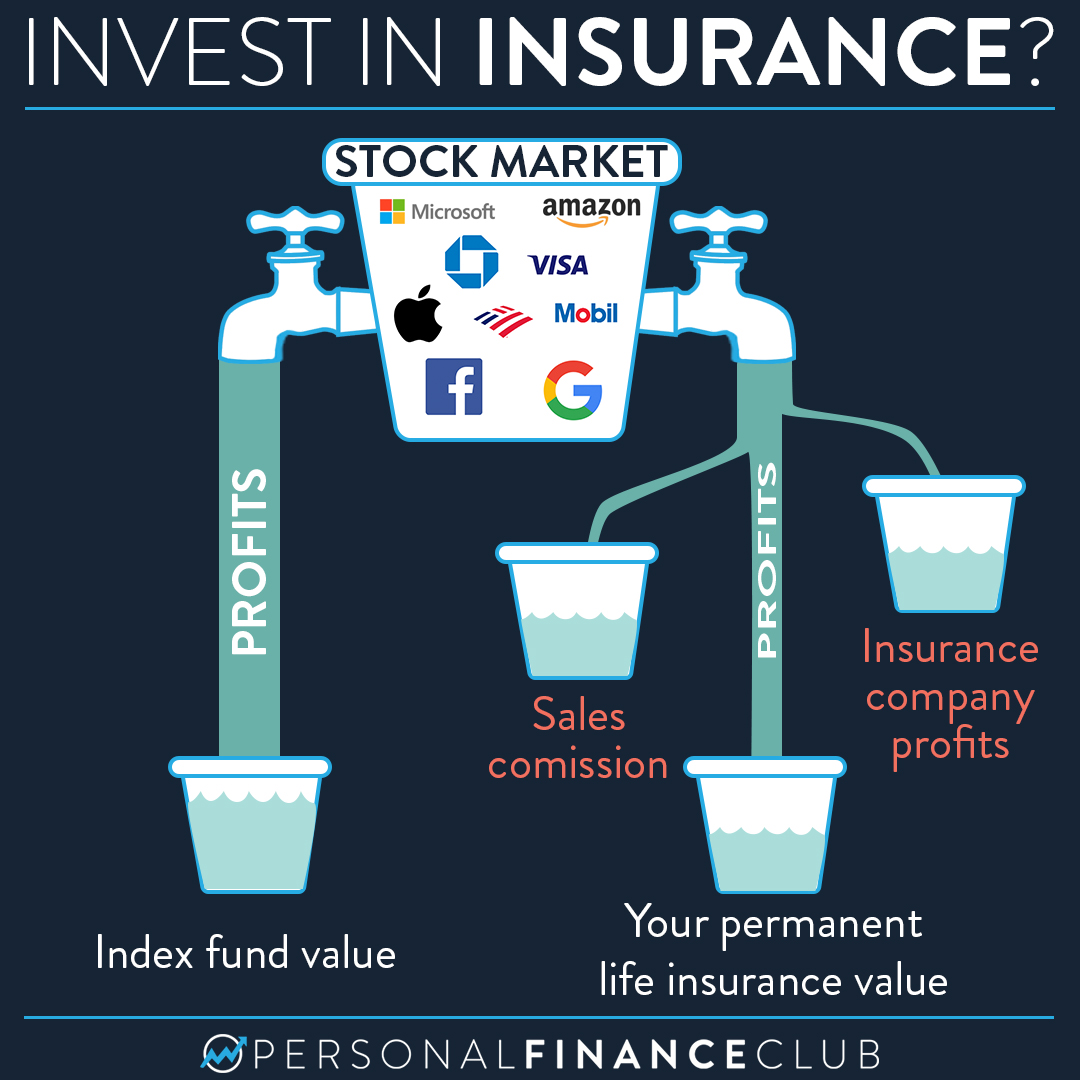

Financing Expenses: Fundings against the policy build up passion and, if not repaid, decrease the death benefit that is paid to the beneficiary. Market Involvement Limits: For a lot of plans, investment growth is tied to a stock exchange index, however gains are usually covered, restricting upside potential - best indexed universal life insurance. Sales Practices: These plans are often offered by insurance policy representatives who might stress benefits without totally describing costs and threats

While some social media sites pundits recommend an IUL is a substitute item for a 401(k), it is not. These are various products with different objectives, features, and expenses. Indexed Universal Life (IUL) is a type of long-term life insurance policy that additionally uses a cash worth part. The money value can be utilized for several purposes including retirement savings, supplemental revenue, and other economic demands.

Latest Posts

Indexed Universal Life Insurance Vs Whole Life Insurance

Wrl Index Universal Life Insurance

Iul Insurance Explained