All Categories

Featured

[/image][=video]

[/video]

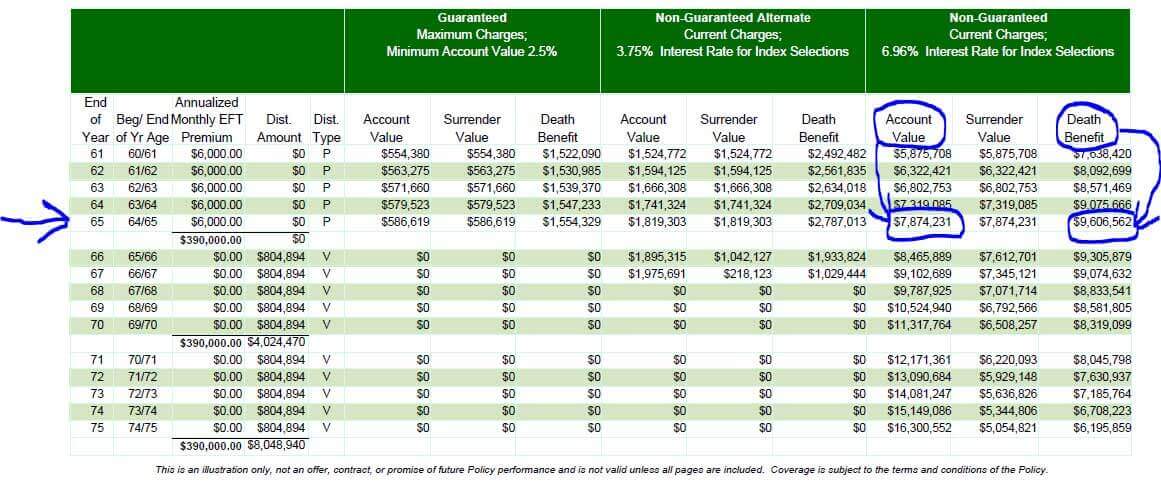

This can lead to much less advantage for the insurance holder contrasted to the financial gain for the insurer and the agent.: The illustrations and presumptions in marketing materials can be deceptive, making the policy seem a lot more appealing than it may actually be.: Realize that monetary consultants (or Brokers) gain high compensations on IULs, which can affect their suggestions to offer you a plan that is not ideal or in your finest interest.

A lot of account alternatives within IUL products ensure one of these limiting factors while enabling the various other to float. One of the most typical account option in IUL policies features a floating yearly rate of interest cap between 5% and 9% in current market conditions and a guaranteed 100% involvement rate. The passion made equals the index return if it is less than the cap but is covered if the index return goes beyond the cap rate.

Other account options may consist of a floating participation rate, such as 50%, without any cap, implying the rate of interest attributed would be half the return of the equity index. A spread account credit histories interest over a floating "spread rate." For instance, if the spread is 6%, the interest credited would certainly be 15% if the index return is 21% however 0% if the index return is 5%.

Rate of interest is usually credited on an "annual point-to-point" basis, suggesting the gain in the index is determined from the point the costs got in the account to precisely one year later. All caps and participation rates are then applied, and the resulting rate of interest is attributed to the plan. These prices are readjusted every year and used as the basis for calculating gains for the following year.

Rather, they use options to pay the interest guaranteed by the IUL agreement. A phone call alternative is a monetary contract that offers the alternative buyer the right, however not the responsibility, to buy a possession at a defined cost within a details amount of time. The insurance provider buys from an investment financial institution the right to "buy the index" if it exceeds a specific degree, called the "strike price."The service provider could hedge its capped index obligation by buying a phone call choice at a 0% gain strike rate and creating a telephone call choice at an 8% gain strike price.

Are Iul A Good Investment

The budget plan that the insurance provider needs to buy alternatives depends on the return from its basic account. For example, if the provider has $1,000 web costs after reductions and a 3% yield from its basic account, it would assign $970.87 to its general account to expand to $1,000 by year's end, using the staying $29.13 to buy options.

This is a high return assumption, reflecting the undervaluation of alternatives on the market. The 2 biggest factors influencing floating cap and involvement rates are the yields on the insurance provider's basic account and market volatility. Service providers' basic accounts mainly are composed of fixed-income properties such as bonds and home loans. As yields on these possessions have actually declined, providers have actually had smaller sized allocate buying options, resulting in decreased cap and participation prices.

Carriers generally illustrate future performance based on the historic efficiency of the index, using existing, non-guaranteed cap and involvement rates as a proxy for future efficiency. This method might not be practical, as historical forecasts commonly mirror higher previous rate of interest and presume constant caps and involvement rates despite different market conditions.

A far better technique could be designating to an uncapped participation account or a spread account, which involve purchasing relatively inexpensive alternatives. These strategies, nevertheless, are much less steady than capped accounts and may need frequent modifications by the carrier to show market conditions properly. The story that IULs are conventional items delivering equity-like returns is no more lasting.

With sensible assumptions of options returns and a reducing allocate purchasing alternatives, IULs may give partially higher returns than traditional ULs however not equity index returns. Potential customers ought to run images at 0.5% above the rate of interest credited to traditional ULs to analyze whether the policy is correctly funded and capable of delivering assured efficiency.

As a relied on partner, we work together with 63 premier insurer, ensuring you have accessibility to a diverse variety of options. Our solutions are completely cost-free, and our specialist advisors give objective suggestions to aid you find the very best protection customized to your needs and budget. Partnering with JRC Insurance coverage Team means you obtain tailored solution, competitive rates, and satisfaction understanding your monetary future is in qualified hands.

The Truth About Indexed Universal Life Insurance

We aided thousands of families with their life insurance coverage requires and we can aid you too. Specialist reviewed by: High cliff is an accredited life insurance policy agent and one of the proprietors of JRC Insurance coverage Team.

In his leisure he enjoys costs time with family, taking a trip, and the outdoors.

Variable plans are financed by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Business, One National Life Drive, Montpelier, Vermont 05604. Be certain to ask your economic advisor regarding the long-lasting treatment insurance plan's features, advantages and premiums, and whether the insurance is suitable for you based on your economic scenario and objectives. Disability earnings insurance normally offers month-to-month earnings benefits when you are unable to function due to a disabling injury or illness, as defined in the policy.

Money worth grows in a global life policy via credited interest and lowered insurance policy costs. If the plan gaps, or is given up, any outstanding exceptional fundings gain in the policy plan be subject to ordinary average earningsTax obligations A fixed indexed universal life insurance policy (FIUL)plan is a life insurance product that provides gives the opportunityChance when adequately sufficientlyMoneyed to participate take part the growth of the market or an index without directly investing spending the market.

Latest Posts

Indexed Universal Life Insurance Vs Whole Life Insurance

Wrl Index Universal Life Insurance

Iul Insurance Explained